How Much Car Can You Really Afford? Budgeting Tips for Canadian Buyers

How much car can you really afford? Budgeting tips for Canadian buyers will be provided in this article to help you make an informed decision. We’ll cover assessing your finances, setting savings goals, and understanding all costs related to car ownership in Canada.

Key Takeaways

- Assess your financial situation and create a realistic budget to determine how much you can afford for a car.

- Consider the total cost of ownership, including insurance, fuel, and maintenance, to avoid financial surprises later.

- Explore different financing options and use pre-approval to strengthen your negotiating power during the car-buying process.

Assess Your Financial Situation

Before visiting a dealership, assess your financial situation to avoid overspending and ensure your car purchase fits comfortably within your budget. Start by reviewing your monthly income and fixed expenses to get a clear picture of your financial health. This will not only make your car-buying experience smoother but also more enjoyable.

Creating a budget ensures your car purchase is affordable and stress-free. For a tighter budget, consider a more budget-friendly car to avoid financial strain. Using car affordability calculators online can also help you determine how much you can realistically allocate towards a car purchase.

A lower debt load improves your chances of getting approved for a car loan. Recognize that a larger car payment may reduce the amount available for future borrowing needs. Carefully assessing your finances helps you make a confident decision that fits your lifestyle and budget.

Calculate Your Monthly Income

List all regular income sources, including salary, side jobs, and freelance work, to determine your total monthly income. This step is critical in figuring out how much you can afford to spend on a car.

Track Your Expenses

Track your monthly expenses to understand your financial situation and accurately budget for a car purchase. Include recurring costs like mortgage payments, utilities, groceries, and other fixed expenses. Include variable costs such as dining out and entertainment for a comprehensive view of your monthly expenses.

A clear understanding of your expenses helps you allocate your finances more effectively and prepares you for future expenses, such as a car purchase. This is essential for creating a realistic budget that reflects your spending habits and financial obligations.

Set Savings Goals

Setting savings goals is vital. Allocate a portion of your savings specifically for vehicle expenses, ensuring it aligns with your overall financial strategy. Limit car expenses to about 15% of your total monthly budget to maintain financial stability.

Set a savings target that allows you to purchase a vehicle without relying on loans, helping you avoid long-term debt. Establish a timeline for your car purchase to motivate you to reach your savings goals effectively.

Budgeting apps can assist you in tracking your progress towards your car savings goal.

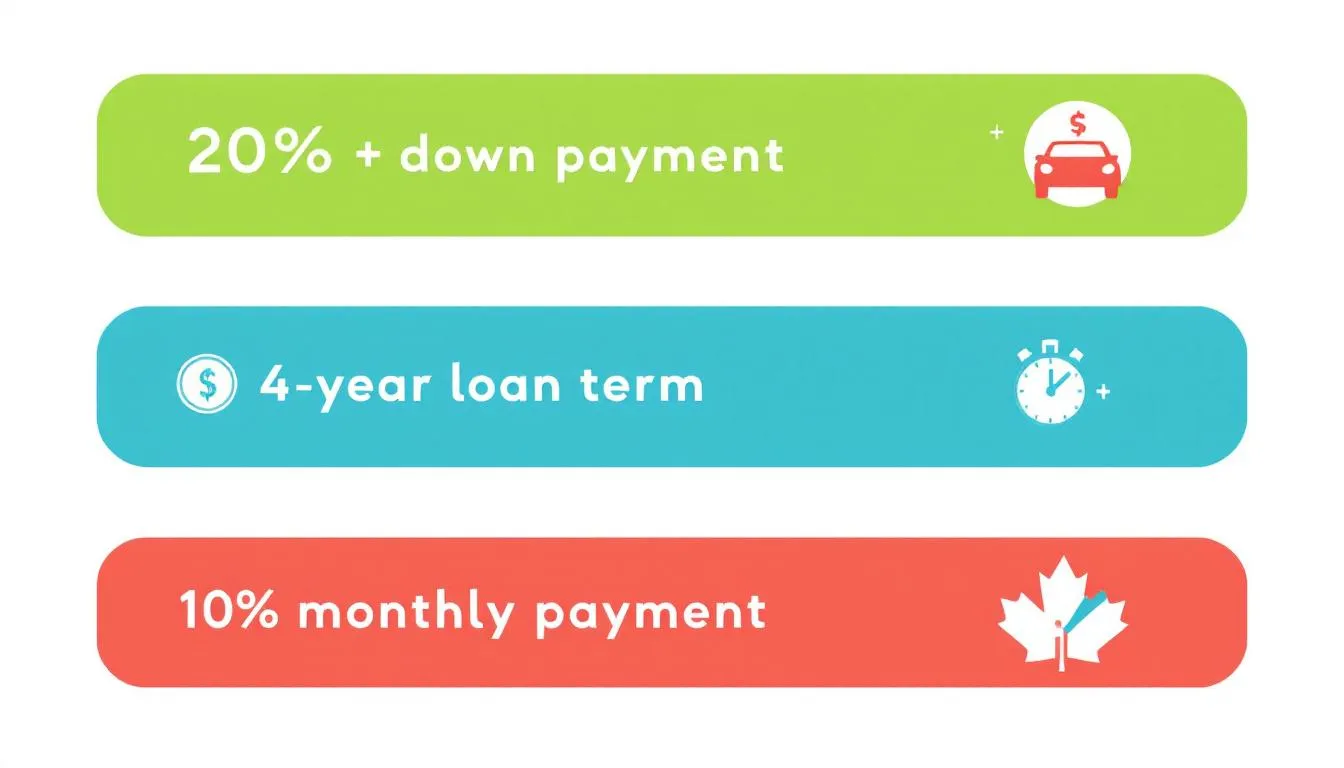

The 20/4/10 Rule: Is It Practical?

The 20/4/10 rule recommends a 20% down payment, a 4-year loan term, and allocating 10% of your monthly income to car-related expenses. Many Canadians find this rule impractical due to rising car prices and unique financial situations. Various budgeting guidelines can help you assess affordable car payments amidst rising vehicle costs.

Alternative budgeting strategies can assist buyers in determining affordability when purchasing a vehicle. Find a budgeting rule that suits your financial situation and helps you make informed decisions.

Down Payment Considerations

A larger down payment can significantly reduce the total interest paid over the life of the loan. A 20% down payment means less principal left to finance, leading to lower monthly payments. With a 20% down payment, the total borrowing cost for a car loan could be as low as $8,826.

Ultimately, a larger down payment reduces financial stress and strengthens your negotiating position for loan terms. It’s a smart move that can save you money in the long run.

Loan Term Limitations

The 20/4/10 rule suggests a maximum loan term of 4 years. Key points include:

- Interest costs can more than double if you extend a loan term beyond 4 years.

- A shorter loan term decreases overall interest costs.

- A shorter loan term helps avoid negative equity situations.

Monthly Payments Cap

Capping monthly vehicle expenses at 10% of your income helps maintain financial health and avoid unnecessary debt. This cap is crucial for maintaining a healthy financial balance.

Exploring Alternative Budgeting Rules

Though a good starting point, the 20/4/10 rule may not be practical for everyone. The 15% rule suggests:

- Your monthly car payment should not exceed 15% of your take-home pay.

- This guideline ensures your car expenses remain manageable within your budget.

- It provides more flexibility while keeping your finances in check.

Adapting your car budget involves assessing your unique financial circumstances and setting realistic spending limits. Personalize your car budget by defining needs versus wants to avoid overspending.

The 15% Rule

The 15% rule suggests limiting your monthly car payment to no more than 15% of your take-home pay. This rule helps reduce financial strain and make car ownership more manageable.

Customizing Your Budget

Tailor your budget for car expenses by considering your overall financial situation, including essential expenses like housing and food.

A flexible budget allows you to allocate funds for unexpected car ownership expenses.

Total Cost of Ownership

When budgeting for a car, consider the total cost of ownership, which includes more than just the purchase price. Insurance premiums, fuel costs, and maintenance expenses can significantly impact your budget. Many drivers overlook these ongoing costs, leading to financial surprises later.

Careful planning for a car purchase is essential due to rising car prices, interest rates, and ownership costs. Evaluating your financial situation and preparing for total ownership costs helps you avoid financial surprises after purchase.

Insurance Premiums

Insurance premiums can vary based on factors like driving history and location.

Factor these costs into your financial plan to avoid unexpected budget strain.

Fuel Costs

Estimate fuel costs by multiplying the average fuel price by your expected monthly mileage and the vehicle’s fuel efficiency.

This is crucial for budgeting car expenses.

Maintenance and Repairs

Annual maintenance and repair costs average around $1,786 for gas vehicles, including regular upkeep and tire replacements. Set aside funds for regular maintenance and unexpected repairs to ensure financial readiness.

Financing Options

Exploring various financing options is crucial for Canada buyers. About 46% of Canadians prefer financing options over paying cash for a car. Compare interest rates, loan terms, and down payment requirements when exploring financing options.

Prioritize safe and secure transactions by exploring platforms with secure payment processes. Purr, for instance, offers a user-friendly platform that unites buyers, sellers, and dealers, making the marketplace safer and more profitable.

Traditional Car Loans

Traditional car loans, secured from banks or credit unions, require regular payments over a fixed term. Obtaining a car loan from a bank or credit union often involves a straightforward application and can result in competitive interest rates.

Dealer Financing

Dealerships often provide financing options through their own lending divisions or partnerships with financial institutions, making it convenient for buyers. Promotional financing options, such as cash rebates or low-interest rates, may be available through dealerships to incentivize purchases.

Leasing vs. Buying

Leasing a car typically involves lower monthly payments and allows you to drive a new vehicle every few years. Buying a car means you’ll own the vehicle outright after completing payments, potentially leading to long-term financial benefits.

Pre-Approval Process

The pre-approval process for an auto loan refines your affordability and supports confident purchasing. Pre-approval simplifies the car-buying process, allowing for easier negotiations and decision-making. Evaluate various financing methods, such as loans from banks, credit unions, and dealership offers, to find the most suitable option for your financial situation.

Use interest rate comparisons and loan terms to determine the most suitable financing option. Securing pre-approval streamlines your car-buying journey and helps avoid potential financial pitfalls.

Benefits of Pre-Approval

Pre-approval for an auto loan helps you understand your affordability and provides a clear budget, allowing you to make informed decisions during your car purchase.

Pre-approval for financing enables you to negotiate from a position of strength, improving your negotiating power by clarifying your budget.

Steps to Get Pre-Approved

To get pre-approved, provide your financial details and desired loan terms to a lender. This includes personal and financial details, such as income and housing information.

Pre-approved loan offers are usually valid for 30 to 60 days, giving you time to find a vehicle.

New vs. Used Cars

Deciding between a new and used car can significantly impact your budget and long-term financial health. New cars typically come with a manufacturer warranty, providing peace of mind against repairs. Additionally, purchasing new vehicles allows customization options tailored to buyer preferences.

Exploring certified pre-owned vehicles can provide a balance between cost and reliability. Assessing your needs versus wants is crucial when deciding on the type of car to purchase. Weighing cost factors against desired features and reliability will help you make an informed decision.

Advantages of New Cars

Buying a new car provides various benefits, including:

- The latest technology

- Advanced features in safety, entertainment, and fuel efficiency

- Warranties that provide a safety net for repairs and maintenance, often lasting several years.

Overall, buying a new car ensures you benefit from advanced technology and reliable warranties, making it a worthwhile investment to buy.

Benefits of Used Cars

Buying a used car often provides a significant reduction in purchase price compared to new cars. Used cars can offer better value because they often experience less depreciation after the initial purchase. Additionally, considering used vehicles can further enhance your options.

When buying a used car, it’s advantageous to consider those that are one or two years old for optimal value. Purchasing used cars from certified dealerships can ensure better value and reliability.

Hidden Costs to Consider

Experts suggest budgeting for hidden expenses related to car ownership, estimating an additional $100–$200 a month. The main expenses involved in owning a car include:

- Loan payments

- Insurance payments

- Maintenance costs Buyers should also account for ongoing costs such as:

- Taxes

- Registration in addition to the car’s purchase price.

Following the 20/4/10 guideline can help buyers avoid financial pitfalls, particularly in a market characterized by rising prices. It’s essential to factor in these hidden costs to gain a comprehensive understanding of the total cost of car ownership.

Taxes and Registration Fees

When purchasing a car, it is important to consider both taxes and registration fees as they add to the overall cost. The main taxes and fees to account for include sales tax and registration fees. Dealers often do not include these costs in their advertisements, so buyers need to be mindful of these additional expenses.

The addition of taxes and fees can lead to higher monthly payments and additional costs than initially anticipated.

Extended Warranties

Investing in an extended warranty can provide financial relief by covering unexpected repair costs over time. Drivers of expensive-to-maintain cars can benefit from warranties that cover repair costs, preventing large unplanned expenses. Obtaining an extended warranty can mitigate the financial impact of unexpected repairs for high-maintenance vehicles.

Having an extended warranty provides peace of mind by ensuring that owners are protected against potential future repair costs.

Additional Services

Hidden costs associated with car ownership can significantly impact your overall budget, including:

- Insurance premiums

- Fuel costs

- Routine maintenance Taxes and registration fees are additional expenses that contribute to the initial costs of purchasing a car.

Extended warranties provide peace of mind but can also increase monthly payments, impacting the total cost of ownership.

Negotiation Tips

Negotiating the best price for a car can be a daunting task, but with the right strategies, you can secure a great deal. Here are some key strategies:

- Be prepared with a maximum price in mind before starting negotiations.

- Securing pre-approval can enhance your leverage when negotiating a vehicle’s price.

- Researching a vehicle’s market value helps you negotiate effectively by providing a basis for pricing.

The initial offer from the dealer is often higher than the sticker price they are willing to accept, allowing room for negotiation. Being informed and confident can make a significant difference in securing a favorable price.

Research Market Prices

Having pre-approval strengthens your position during negotiations, enabling a better deal. Researching market prices is crucial for understanding what constitutes a fair price for a vehicle. Market research helps buyers compare vehicle prices and features, ensuring they make an informed decision.

Knowledge of market prices, combined with pre-approval, empowers buyers to negotiate effectively.

Be Prepared to Walk Away

Understanding your budget is critical, as it helps you determine how much you can afford to pay for a vehicle without overextending your finances. Researching market prices allows potential buyers to gauge fair pricing and strengthens their confidence in negotiations.

Having a pre-approval can provide a clear budget and significantly enhance your negotiating power when purchasing a vehicle. Be prepared to walk away if the deal does not meet your budget; remember, there are always more options available.

Leverage Pre-Approval

Having pre-approval typically positions you as a cash buyer, which can enhance your negotiating leverage. This makes the negotiation process smoother and can result in a better deal for your car purchase.

Summary

In conclusion, determining how much car you can afford involves carefully assessing your financial situation, setting realistic budgeting goals, and exploring various financing options. Following traditional budgeting rules like the 20/4/10 rule or the 15% rule can guide your decision-making process. Equally important is considering the total cost of ownership, including hidden costs like insurance premiums, fuel costs, and maintenance expenses.

By taking these steps, you can make an informed decision that fits comfortably within your budget and ensures financial stability. Remember, the key to a successful car purchase is thorough planning and understanding your financial limits. Armed with this knowledge, you’re ready to embark on your car-buying journey with confidence and clarity.

Frequently Asked Questions

How do I calculate my total monthly income for car budgeting?

To calculate your total monthly income for car budgeting, just list all your regular income sources, like your salary and any side gigs, then add them up. This gives you a clear picture of what you can afford!

What is the 20/4/10 rule in car budgeting?

The 20/4/10 rule is a smart guideline for car budgeting: put down 20%, finance for 4 years, and keep car expenses within 10% of your monthly income. Stick to this rule, and you’ll keep your finances in check!

Why is it important to consider the total cost of ownership when buying a car?

It’s crucial to consider the total cost of ownership when buying a car because it includes all expenses like insurance, fuel, and maintenance, helping you avoid financial surprises and stick to a realistic budget.

What are the benefits of getting pre-approved for an auto loan?

Getting pre-approved for an auto loan gives you a clear picture of what you can afford, makes the car-buying process smoother, and boosts your negotiating power. It’s a smart move that can save you time and money!

How can I negotiate the best price for a car?

To negotiate the best price for a car, it’s crucial to research market prices and get pre-approved for financing. Remember, don’t hesitate to walk away if the deal doesn’t fit your budget!

Latest Vehicles

All VehiclesRelated Posts